Well it was bound to happen, San Diego home sale figures have dropped to their lowest level in years most likely driven by affordability and interest rates.

In the month of June there were 3,927 home sales in San Diego County, CoreLogic said, which is the lowest in four years. But all the market indicators are great in terms of job growth, low unemployment, and wages resulting in Junes median home price hitting its highest price.

Due to no the small number of homes being built during the recession, there just isn’t enough homes to keep up with demand causing prices to skyrocket. But as these prices become less affordable, you will start to see homes sitting on market longer than they have in the past.

Chris Thornberg, economist and founding partner of Beacon Economics, said looking too much at the recent slowdown in sales is not the smartest idea. He said the economy is still strong and looking at sales numbers alone doesn’t tell the whole story.

“There’s just not a lot there to panic about,” he said. “It’s just a really tight market out there. There’s just not much to sell.”

There is no doubt that the desire for homeownership in San Diego County is strong, said Evan Morris, real estate agent based in Golden Hill. However, he has had potential buyers start to draw the line with rising prices.

“People don’t want to pay $350,000 for a one bedroom, one bathroom (condo),” he said.

However, Morris said there is opportunity for buyers if homes stay on the market longer, especially with many homes for sale that are priced much higher than what other homes in a neighborhood are going for. He said he recently was able to get $60,000 off the asking price for his clients purchasing a home in Bay Ho.

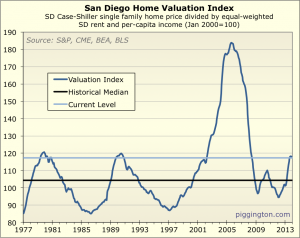

When it comes to house valuations, real estate agents and sellers have always complained about how appraisers are sinking deals with low and possibly inaccurate appraisals. You might be surprised to find that they might be doing a better job of getting it right.

When it comes to house valuations, real estate agents and sellers have always complained about how appraisers are sinking deals with low and possibly inaccurate appraisals. You might be surprised to find that they might be doing a better job of getting it right.

Sometimes it might be difficult to come up with a sales price on a larger home that might be much larger than the predominant homes in the area. This is where a home listing appraisal by Appraise All really helps out, but these will help guide your way if you decide to do it on your own.

Sometimes it might be difficult to come up with a sales price on a larger home that might be much larger than the predominant homes in the area. This is where a home listing appraisal by Appraise All really helps out, but these will help guide your way if you decide to do it on your own.

The

The

From time to time you really need that appraisal yesterday. We know how it is. You might have waited till the last minute to file your taxes and you need to get an appraisal on your San Diego Home, we can help you with that.

From time to time you really need that appraisal yesterday. We know how it is. You might have waited till the last minute to file your taxes and you need to get an appraisal on your San Diego Home, we can help you with that. Bryan Knowlton is one of the leading appraisers in the area as well as a highly requested speaker, author, consultant and more.

Bryan Knowlton is one of the leading appraisers in the area as well as a highly requested speaker, author, consultant and more.